Cash-out Refinance During COVID-19

04-23-2020About MortgagesEddie KnoellIn this episode, we talked about and answered questions about cash-out refinances in our current COVID-19 market. Right now, we’re still sheltering in place and we’re getting a ton of calls from people about a range of topics, but a lot of them surround the issues posed by COVID-19 and whether they should do a cash-out refinance, if they should pull money out for emergency funds, and about investing.

Stock Market

Now we’re not financial planners, but when a customer calls us asking about the stock market, our advice tends to be that your home is not a stock. If you’re going to take cash out of it and put it in the market then you’re viewing your home as and treating it like a stock, like an investment. Your primary residence should just be the asset that you live in. Don’t touch it for investments. Doing so is much different than investing in a home and using the equity that is building to help build your wealth.

What to do with your emergency fund

The emergency fund is an interesting question because in certain cases it can make sense. Let’s say that you’re in a job right now that’s in question. If you need the funds to live and keep your life as secure as possible, we would say that the cash-out refinance does make sense, particularly if you’re looking for that six-month emergency fund.

We’ve had borrowers and friends tell us, “It’s not until these days that I’ve realized just how unprepared I am. We just don’t have that necessary backup.” So again, we’re not big advocates of investing in the stock market with your equity but rather using your equity to make your home and your family safer.

Cash-out refinances

Is now the right time? Interest rates are near lows, but we’re not sure how much further they are going to drop.

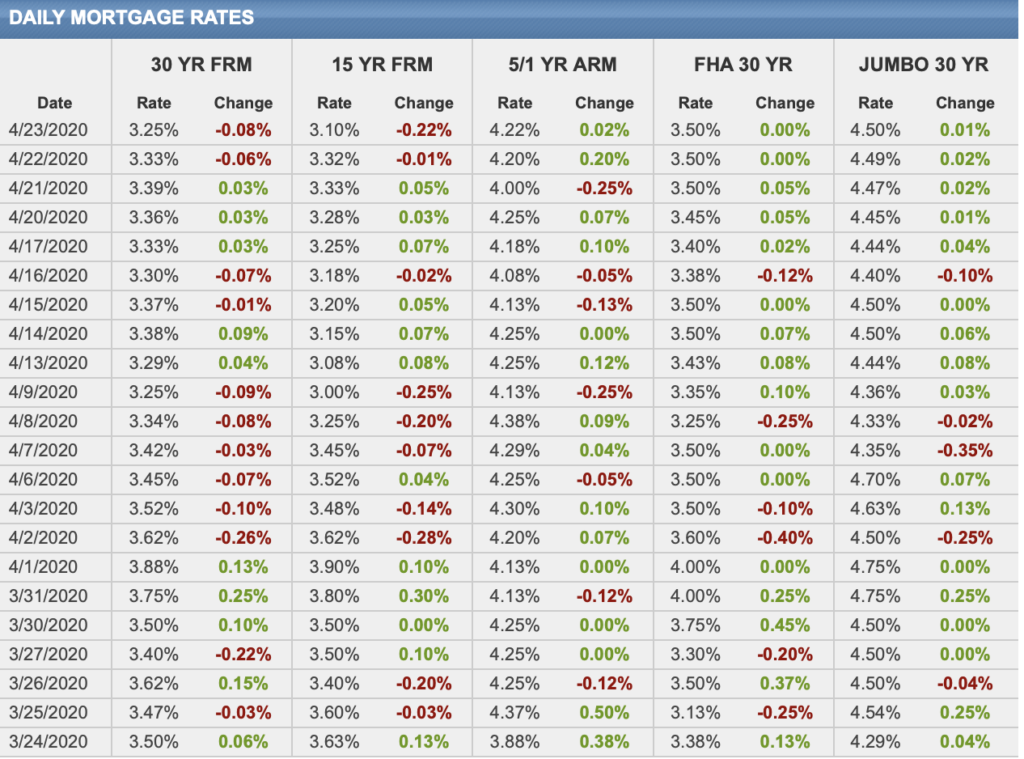

The above picture is from Mortgage News Daily. It takes all these lenders out there that are quoting rates and averages them out. You can see that on the 20th the average rate that was quoted on a 30-year fixed was 3.42. Now, there was a point that these rates were down to 3% in very early March, but now is still a good time to refinance. We’re getting a ton of demand for it, and with demand this high, banks don’t have a strong incentive to lower these rates much further. It’s probably not worth the risk of waiting for another 30 to 60 days to see if the rates can be squeaked down a little bit because if they do, it’ll be incremental, maybe an eighth of a percent.

What about home values?

Right now, we’re not really seeing a big shift in home values. We’re getting appraisals back at almost target price. We’re not far enough into it yet. Overall, we say home pricing is not a concern right now and it shouldn’t really affect someone’s decision on a cash-out refi. So, if you’re a good candidate to take cash out, today is a good time. While potentially we might have lower values further down the line, they likely won’t be a lot lower.

Debt Consolidation

Now’s a good time to consolidate and get out of that high-interest rate, credit card debt. When it comes to funding an emergency fund, for getting out of the high auto loan interest rates or getting out of the high credit card interest rate debts, then the cash-out does make sense. The only asterisk we really put out there is don’t do it just because you’re bored and don’t turn your home into a brokerage account, your home needs to be safe.

If you have any questions about this or if you have any questions you’d like us to answer on our podcast, you can email your questions to team@azmortgagebrothers.com or give us a call at (602) 535-2171. Be sure to ask us for a free quote on your next mortgage. We’ll personally work with you and help you through the whole process.

•••

Thanks for listening and reading the Mortgage Brothers Show. Let us know if you have any questions you’d like us to answer on this podcast. You can email your questions to Tom@AZMortgageBrothers.com or Eddie@AZMortgageBrothers.com.

Be sure to ask us for a free quote on your next mortgage. We’ll personally work with you and help you through the whole process.

Signature Home Loans LLC does not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only. You should consult your own tax, legal, and accounting advisors before engaging in any transaction. Signature Home Loans NMLS 1007154, NMLS #210917 and 1618695. Equal housing lender.

BACK TO LIST