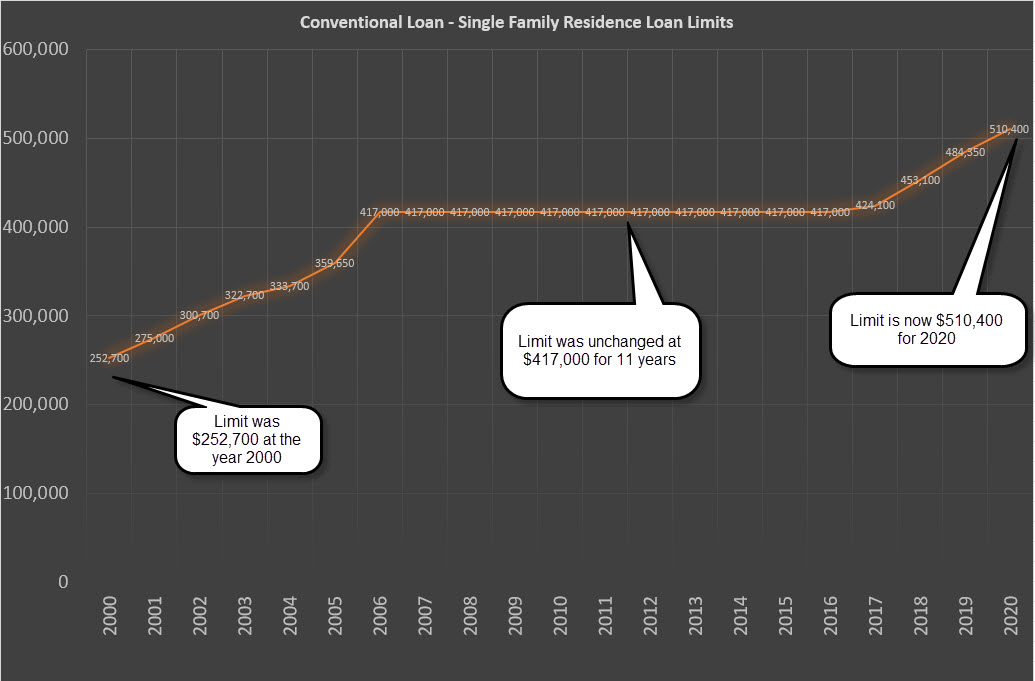

Conventional loan limit in Arizona has just been increased to $510,400

12-03-2019About MortgagesEddie KnoellIn Arizona and most of the US, the conventional loan limits have been increased from $484,350 to $510,400. This is amazing news, just four years ago that limit was $380,000.

What exactly does an increased loan limit mean?

A big portion of this is that the barometer for what is considered to be a jumbo loan has moved. Now, everything over $510,400 is a jumbo loan, where previously it was anything over $484,350.

Now you don’t want a jumbo loan if you can avoid it. They come with higher interest rates and strict guidelines.

What are the other benefits?

This impacts three main areas: purchasing power, refinancing out of jumbo loans, and cash-outs.

Your purchasing power has increased because your 5% down can now go toward a larger house. The purchasing price of your home went up to about $537,000 from $509,000.

Next, because of what qualifies as a jumbo loan has changed, you can actually refi out of the jumbo loan and into a convention mortgage.

Finally, there are new cash-out loan limits. They’re now $510,400 instead of $484,350. So, if your home appraises for in that mid $600,000 range, the cash out loan devalue at 80% would get you that $510,000. So, you’ll get more money on your cash-out.

Now, these are not just limited to single-family residence homes, but also for but a duplex, triplex, or fourplex. You can actually buy a $1.2 million fourplex and get a conventional loan on it. You don’t have to go commercial for that much money. The caveat to this though is you have to put 25% down on three and fourplexes but the loan limit is up to $981,000. However, the point is that you can buy something at 1.2 million, put 25% down, and occupy one of the units, which is great news!

If you have any questions about this or if you have any questions you’d like us to answer on our podcast, you can email your questions to team@azmortgagebrothers.com or give us a call at (602) 535-2171. Be sure to ask us for a free quote on your next mortgage. We’ll personally work with you and help you through the whole process.

•••

Thanks for listening and reading the Mortgage Brothers Show. Let us know if you have any questions you’d like us to answer on this podcast. You can email your questions to Tom@AZMortgageBrothers.com or Eddie@AZMortgageBrothers.com.

Be sure to ask us for a free quote on your next mortgage. We’ll personally work with you and help you through the whole process.

Signature Home Loans LLC does not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only. You should consult your own tax, legal, and accounting advisors before engaging in any transaction. Signature Home Loans NMLS 1007154, NMLS #210917 and 1618695. Equal housing lender.

BACK TO LIST