Oh Canada! What’s Behind the Canadian Real Estate Selloff in the Valley

08-01-2017About MortgagesEddie KnoellListings are hard to come by in today’s tight inventory real estate market, but there’s one segment of sellers that seems eager to sell – Canadian real estate investors.

On Sunday, Catherine Reagor at AZCentral reported that many Canadians are liquidating their real estate holdings in Arizona. According to the article, for every Canadian buyer, there are nine Canadians looking to sell. The number of Canadian buyers has fallen from a peak of 421 Canadian buyers in June of 2011, to just 70 Canadian buyers in June of 2017. Canadian sellers, meanwhile, are liquidating their Phoenix assets. But are they taking their money home? And what’s behind the trend?

Canadians Taking Profits

Canadian buying activity peaked in the Phoenix Valley during the real estate downturn, at one point accounting for more than 6% of total buying activity and helping to stem the tide of falling prices when the market was at its lowest point.

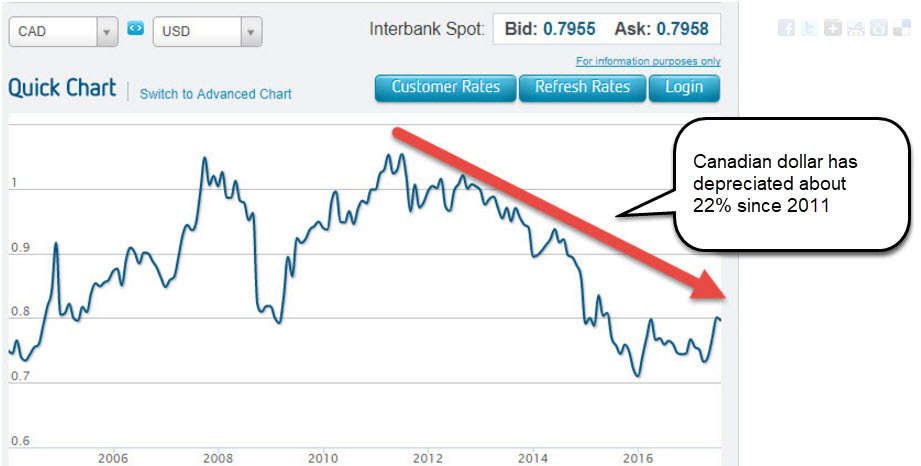

Since then, a lot has changed here in the Valley. Homes bought between 2009 and 2012 have in some cases more than doubled in value, encouraging many Canadian investors to engage in some profit taking. The recovery of the US economy and the weakening of the Canadian dollar due to falling oil prices also has many Canadian property investors feeling financial pressure.

Since 2011, the Canadian dollar has depreciated about 22%. This means that if a Canadian investor in the Valley can profit $50,000 from the sale of an investment property today, they can take that profit back to Canada and purchase about $61,000 worth of investments in Canada. So, not only did they make $50,000 from the profit, they will make an additional $11,000 from just the exchange rate difference from the time they moved the money in 2011. And although Arizona is still the nation’s fifth most popular target for foreign investment, price increases in Phoenix and other western markets has some Canadian sellers looking to reinvest in other parts of the country where upside potential may be higher.

How to Find Canadian Clients

If you’re an agent that worked with Canadian buyers during the real estate downturn, this might be a great time to reach out to those former clients and let them know how the Phoenix market is performing. If you’re newer to the industry and don’t have a pool of Canadians you’ve worked with in the past, title companies can provide you with lists of property owners who have listed Canadian addresses as their mailing address. Go old-school and offer to let these folks know the current value of their home and that you’re available to answer questions about selling.

Another way to find Canadian homeowners is to search the Flexmls Monsoon service for tax mailings address that are in Canada

You can also find Canadian buyers, with a bit more legwork. Setting up referral networks with Canadian real estate agents in second home and vacation markets like Whistler, Victoria BC and Calgary / Banff is one way to uncover potential buyers. A bit of web research and some social media connections could also pay off with referrals of Canadians looking to buy property.

Working with Snowbirds

Working with international investors requires you to have a basic understanding of more than just the local real estate market. You’ll need to be aware of trends in international markets, such as how exchange rates impact your potential clients. You’ll also need to understand the impact of tax laws and reporting such as FIRPTA that impact international investors.

Under FIRPTA, every international investor that sells real estate holdings in the United States is subject to income tax withholding of 15% on sold assets. Sellers are required to disclose their foreign status on the Arizona seller’s property disclosure as well as the listing and sale agreement, and should be encouraged to contact a tax advisor to understand how FIRPTA will impact them.

Buyers also have an obligation under FIRPTA to report and withhold up to 15% of the total sale price to cover seller’s obligations at tax time. Escrow agents cannot provide tax advice or fill out FIRPTA disclosures, tax forms or other declarations, so it’s very important that buyers and sellers fully understand their obligations. Real estate agents can help by ensuring that purchase agreements and disclosures are filled out properly. They can also direct clients to tax and legal experts who can provide additional guidance.

And of course, if you’re working with Canadian buyers you’ll want to contact a knowledgeable mortgage broker with loan programs targeted at foreign investors. Contact The Mortgage Brothers Team today to find out how we can help you take advantage of this market!

BACK TO LIST