Arizona Housing Market Improving

11-29-2012About MortgagesEddie KnoellThe chief housing regulator for the United States recently expressed optimism for the real estate market having muddled through several years of strife and struggle and that means now is the best time to apply for an Arizona mortgage. Phoenix home loan rates will not be as low as they are anytime in the near future, and may never be this low again. Coupled with the incredibly low housing prices in Maricopa County, this may very well be the perfect scenario that eager potential homeowners have been waiting for.

READ MORE

Put Yourself In The Best Position For A Mortgage

11-28-2012About MortgagesEddie KnoellAs an Arizona mortgage broker, I am often asked a number of questions that would-be home buyers are confused about when it comes to approval and the affordability of a home loan. I am always open to answer questions from potential homebuyers, and while some of their questions tend to revolve around points, fees, and percentages, many people don’t realize what they can do to prepare for the opportunity to buy a home.

READ MORE

What’s Ahead For Mortgage Rates This Week

02-13-2012About MortgagesEddie KnoellFor now, mortgage rates remain at all-time lows. According to Freddie Mac’s weekly mortgage rate survey, the average, conforming 30-year fixed mortgage rate held firm last week for mortgage borrowers willing to pay an accompanying 0.8 discount points plus applicable closing costs. 1 discount point is equal to one percent of your loan size.

READ MORE

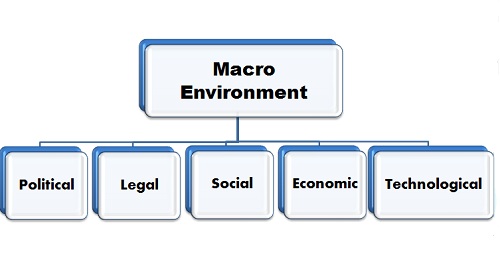

How Macro Factors Influence Mortgage Rates

11-21-2011About MortgagesEddie KnoellMortgage markets are impacted by economic developments around the world, as well as economic developments right here in the United States. One of the reasons is that the secondary market for mortgages is ultimately controlled by Fannie Mae, Freddie Mac and the Federal Housing Administration.

READ MORE

What Is The NAHB HMI?

11-17-2011About MortgagesEddie KnoellEvery month, the National Association of Home Builders (NAHB) publishes the HMI, a report that studies the confidence level of the nation’s home builders. Based on a scale of 1 to 100, a score of 50 and higher bodes well for the industry. This signifies that home builders believe sales conditions will be positive. On the other hand, a score of 49 and below could mean that home builders have negative sentiments toward the industry’s future.

READ MORE

What Is The Difference Between A Condo And A Townhome?

11-02-2011About MortgagesEddie KnoellThere are many developments in Mesa, Tempe, Chandler, Scottsdale, Glendale, and the greater Phoenix area that may appear like condos but they are actually townhomes. They both have similar HOAs and are often marketed to the public as one and the same. Most people think there isn’t a difference between a condo and townhouse but in fact there is a big difference. The difference is in the way ownership is legally structured.

READ MORE

Mortgage Scenario for FHA Condo and Townhouse Home Loan

10-26-2011About MortgagesEddie KnoellA borrower called me today and said that they were approved for $120,000 mortgage to purchase a home in Mesa, Arizona. They wanted to do an FHA mortgage on a condo so they could put 3.5% down payment. The borrower wanted to know if they could do a conventional loan to save on some money. The borrower said they have 3-5% down payment available and a 675 FICO score.

READ MORE

HARP Changes For Fannie Mae and Freddie Mac Help Arizona Homeowners

10-24-2011About MortgagesEddie KnoellIf you have an Arizona mortgage that was originated and sold to Fannie Mae and Freddie Mac before May 31 2009, you are eligible for the Home Affordable Refinance Program (HARP). The original HARP program was limited to borrowers who had a loan to value of 125% or below. Many homeowners have loan to values above 125% and have been unable to take advantage of the low interest rates in the market. Arizona, Nevada, and Florida will benefit the most from these changes to the program since these states have seen the greatest depreciation in home values throughout the country since 2007.

READ MORE

Proof of Income and Employment For A Home Loan

09-01-2011About MortgagesEddie KnoellLoan Scenario 1: A borrower works in a restaurant in Mesa Arizona and is a W2 employee. His income has gone from $9,000 in 2009, $12,000 in 2010, and is on track to make $24,000 in 2011. The borrower does not receive paystubs. He has a payment ledger from the company showing Year to Date earnings and withholdings.

READ MORE

Mortgage Scenarios: Self Employed Borrowers

08-29-2011About MortgagesEddie KnoellScenario 1: I have a borrower who wants to do a rate/term refinance (just refinance borrower’s balance) of his 1st mortgage in Phoenix, Arizona. The loan to value is 76%. Borrower has a 2nd mortgage and a combined loan to value of 87%.

READ MORE

Refinancing for Fannie Mae and Freddie Mac Owned Mortgages

08-16-2011About MortgagesEddie KnoellChase, Wells Fargo, Bank of America etc. may service your mortgage payments BUT chances are, they don’t own your mortgage note. It is probably owned by Fannie Mae or Freddie Mac. You may be eligible for this special Fannie Mae and Freddie Mac refinance. Click here to see if Fannie Mae owns your mortgage. Click here to see if Freddie Mac owns your mortgage.

READ MORE

Residency and Investor Questions for Conventional Loans

08-12-2011About MortgagesEddie KnoellI have a borrower who is a medical Dr. and he has a practice in Globe Arizona and Mesa Arizona. He lives in Globe AZ right now with his family but wants to buy a home in Mesa AZ close to his practice in Mesa. What is the best way to do the loan? What will the underwriters consider the Mesa home in regards to occupancy? Will they consider it a 2nd home or Investment property?

READ MORE