LSU Forms – Loan Status Updates and what you need to know

06-26-2019About MortgagesEddie KnoellWe go through the LSU (Loan Status Updates) which is an Arizona specific form. This is an important form that lenders will need to send to the sellers throughout the purchase transaction. We give our insight on the form and highlight the items we think are important for seller, buyers, and Realtors to be looking at.

READ MORE

What you need to know about the Arizona Prequalification Form

06-20-2019About MortgagesEddie KnoellWe highlight the important line items that borrowers and realtors need to look at in the Arizona Prequalification form. We talk about the advantage of showing a higher loan amount on the prequalification form to show strength if it is a competitive market and multiple offers are expected on homes for sale. We discuss the importance of borrowers sending income and asset documentation so sellers can feel confident in the buyer’s ability to qualify.

READ MORE

Delayed Financing – how to get cashout without waiting 6 months seasoning

06-11-2019About MortgagesEddie KnoellDelayed Financing (Defined Term) has more to do with avoiding normal Seasoning Requirements (6 months) when doing a Cash-Out Refi then really anything else. It could be called “No Seasoning Cash-Out Refinancing”. Basically Someone delays getting financing by first paying cash (or can be from a HELOC, or secure loan) and THEN decides to put financing on the property after COE but doesn’t want to wait the standard 6 months seasoning!

READ MORE

Starting Your Home Loan process: Top 10 Mortgage Do's and Don'ts on purchase transactions

06-07-2019About MortgagesEddie KnoellTop 10 Mortgage DO’s and DON’Ts on home loans when purchasing a home:

READ MORE

Seller Concessions – What can they be used for and what are their limits?

06-05-2019About MortgagesEddie KnoellSeller Concessions are also known as ‘3rd Party Contributions’. Who is a typical interested party in a purchase transaction? Sellers, Buyer Agents and Listing Agents are 3rd party contributions.

READ MORE

How do Solar Panels affect the mortgage and closing process?

05-20-2019About MortgagesEddie KnoellIn this episode, we covered solar panels and how borrowers should view them when looking to buy.

READ MORE

How Student Loans Affect Qualifying For A Mortgage?

04-16-2019About MortgagesEddie KnoellHow do student loans affect qualifying for a mortgage? 70% of college students graduate with a significant amount of loans. Student loans balances are climbing every year and it can greatly affect these borrowers when they try to get approved for a mortgage.

READ MORE

How Student Loans Affect Qualifying For A Mortgage?

04-16-2019About MortgagesEddie KnoellWelcome, everyone. Tom and I have decided to talk about student loans and how they affect mortgages. And this comes from a question that was asked by someone in our audience, a realtor. And we thought this was a great topic.

READ MORE

What are points and how do they affect mortgages?

04-12-2019About MortgagesEddie KnoellWhat are points? Customers are asking about points. Buydown points, buydown rate, how does it work, what is it?

READ MORE

What Goes Into Credit Scores and How They Can Affect Mortgages?

03-29-2019About MortgagesEddie KnoellThe FICO score is actually named after a couple of individuals, and the individuals … who is it? I think it was Bill Fair and Earl Isaac, actually came up with the FICO score. It was Fair and Isaac and Company. That actually has roots that go back quite a ways, and I always thought that that was extremely interesting.

READ MORE

Episode 3: Are Down Payment Assistance Programs the best programs for First Time Home Buyers?

03-19-2019About MortgagesEddie KnoellWell, people call or email us about first time home buyer programs, which we have. And we want to talk about one of the best, we were going to talk about the best first time home buyer program that we have and what we believe is the best first time home buyer program in the country. But people call about down payment assistance programs.

READ MORE

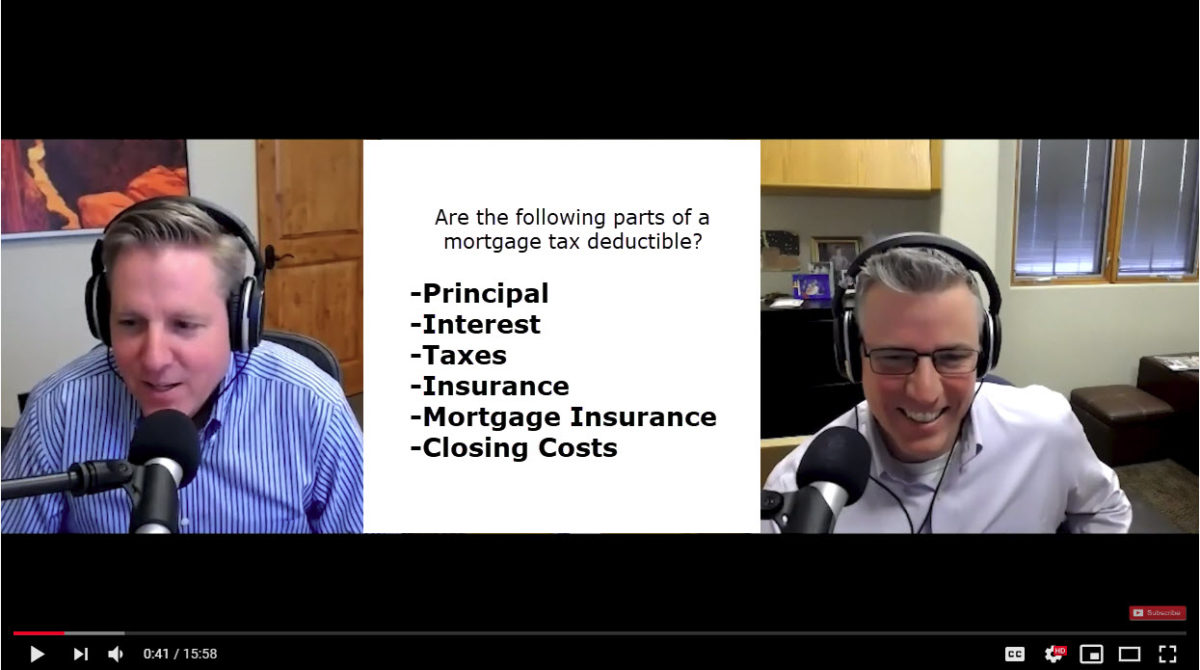

Episode 2: What Parts of a Mortgage Are Tax Deductible?

03-12-2019About MortgagesEddie KnoellIt’s March 12th 2019 and millions of people are in the process of filing their 2018 tax returns. In today’s show, Eddie and Tom Knoell go through the parts of a Mortgage Are Tax Deductible based on the 2018 tax rules. They discuss whether principal, interest, taxes, or insurance are tax deductible as well as what closing costs are tax deductible.

READ MORE

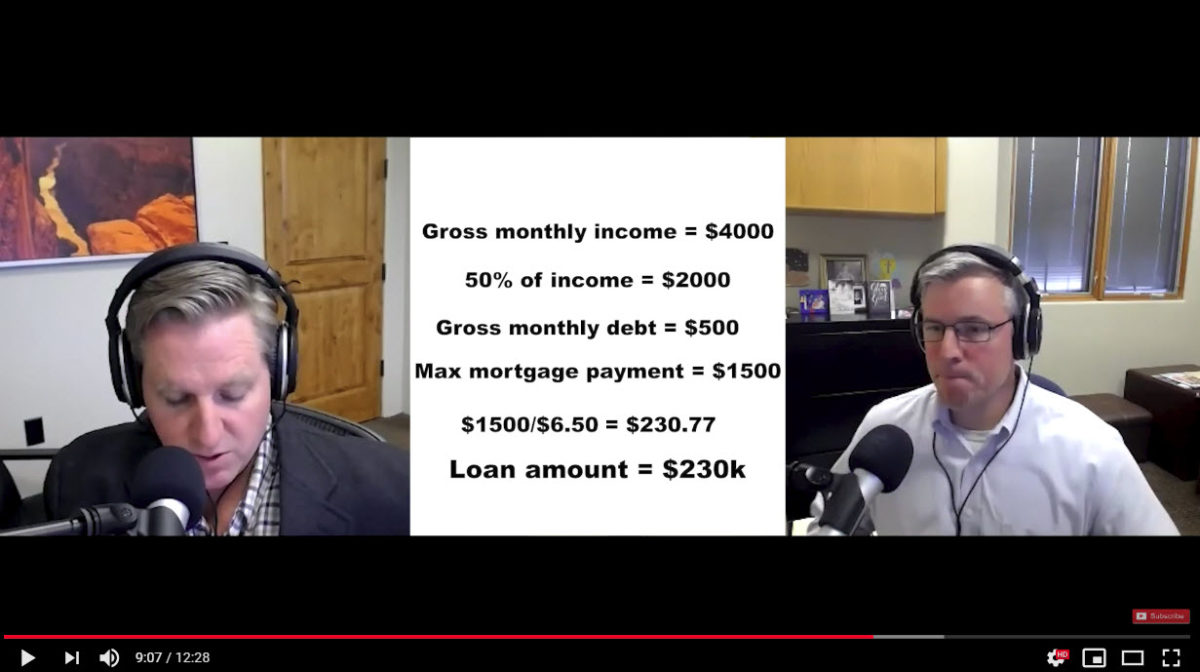

Episode 1: How Much Can I Qualify for a Home Loan?

03-05-2019About MortgagesEddie KnoellWelcome, everybody. This is our first podcast, first official podcast, and I’m telling you, we’re excited. Tom and I, we wanna use this podcast to be answering questions that borrowers have, sellers, buyers, real estate agents, anybody who’s willing to listen and anyone who has questions, we wanna use this podcast as a medium to get all these questions in the mortgage business out to them. Right, Tom?

READ MORE

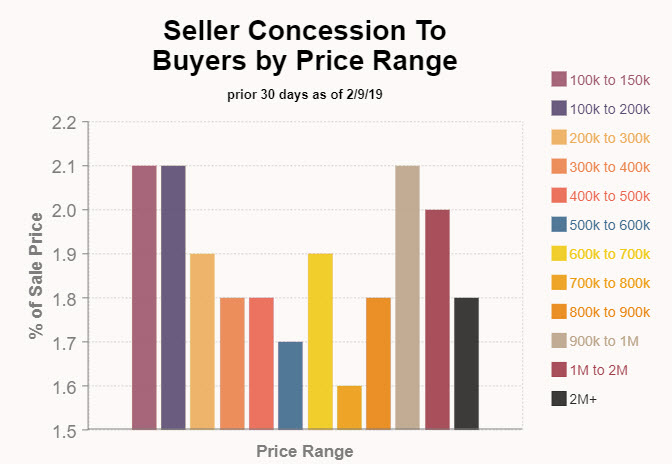

Seller Concessions To Buyers - How Much?

02-12-2019About MortgagesEddie KnoellAttached and Detached Resales in the Greater Phoenix Metro Area for prior 30 day period as of 2/9/19

READ MORE

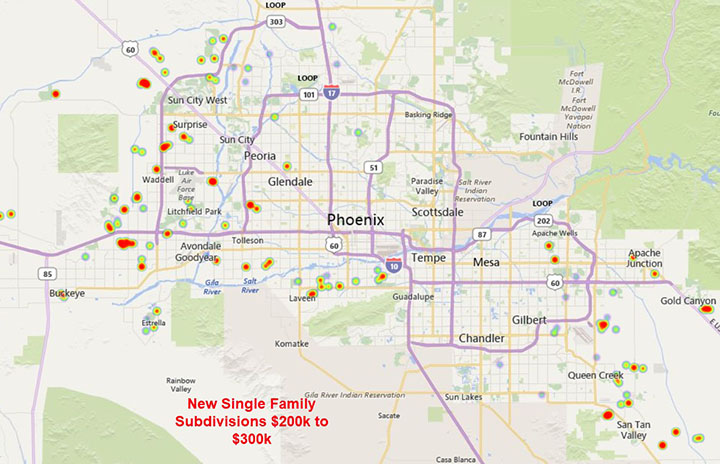

Where Are the $200k to $300k Single Family Homes in the Greater Metro Phoenix Market Area?

02-04-2019About MortgagesEddie KnoellThe $200,000 to $300,000 price range is the hottest market in terms of market share in the Greater Phoenix Metro Area accounting for 44% of the sales of resale single family houses in January 2019!

So where are all the affordable single family homes?

READ MORE