Payoff Credit Cards with Cashout Refinance - Is it Worth?

07-27-2022About MortgagesWe're at a really interesting time right now. Most people who have a mortgage on their home have an interest rate that is much lower than what is available on the market today. People are proud of their low interest rates and they want to hold on to them as long as possible.

But everyone is human and the habit of spending money and increasing credit card debt can happen. Just because interest rates change doesn’t mean people’s spending habits change. Homeowners eventually ask us if it makes sense for them to refinance to payoff the high interest credit cards.

One of the best ways that you can handle credit card debt is by using the equity you have in your home. That's what we're talking about in this post — using a cashout refinance to help pay off credit card debt.

An example of using a cashout refinance to pay off credit card debt

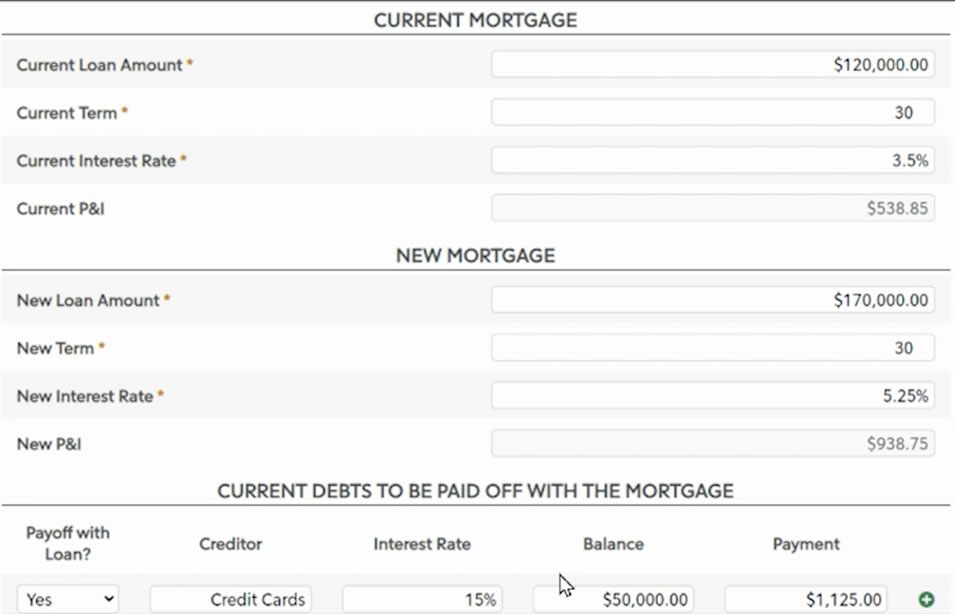

In this example, someone has a $120,000 current mortgage. It’s a 30-year fixed, and they have a good interest rate of 3.5%.

They also have $50,000 in credit card debt at a 15% interest rate.

So, what they can do is take out a new mortgage of $170,000 with a new interest rate of 5.25%. Now, yes, their interest rate increases but this new rate is much lower than the 15% they’d be paying on the credit card debt.

You can take a look at this all charted out below.

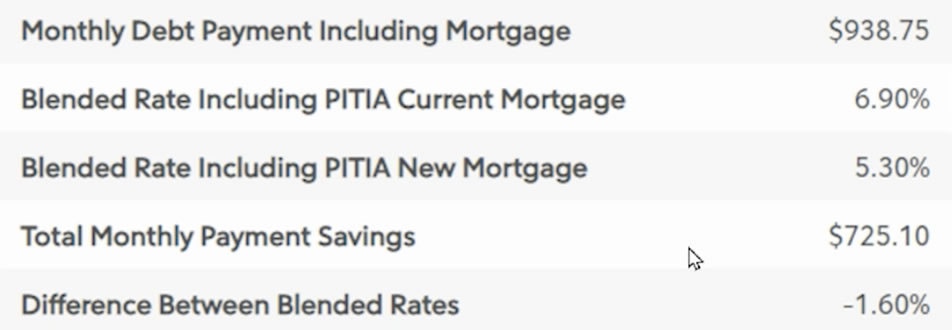

To see what the savings would be we want to look at the blended weights combined. This is also known as the weighted average.

Combining the credit card debt into the mortgage decreases the combined interest rate to 1.6% and reduces the overall payment by $725/month in this example.

Not only is there a net savings in the overall cost for the money that’s borrowed, but also there’s going to be surplus extra cash that you're gonna have every month because of your monthly payment dropping. Now sometimes paying less every month doesn’t necessarily mean you’ll be saving money over the lifetime of the loan, for example, you go from a 30-year to a 50-year loan.

It’s also good to remember that you can always refinance again if interest rates go down in the future. So, we’re basically locking in savings right now. And in the future, we can lock in even more savings if that opportunity presents itself.

We hope that helps everyone. Be sure to call us at 602-535-2171 or email us at team@azmortgagebrothers.com. We'll be happy to help you through your scenarios or anything else mortgage related that you might need.

BACK TO LIST