As Phoenix Home Prices Continue to Rise, It’s Still a Good Time to Buy

09-11-2018About MortgagesEddie KnoellHere in Phoenix, home values have been steadily increasing and the long term trend has favored sellers over buyers. This means, if you’re worried you won’t get your money out of the house you’re thinking of buying when you sell, don’t be. It’s still a good time to buy.

For the past ten years, the U.S. economy has been enjoying a period of economic expansion that is the second longest in our history. If the past is any indication, we are due for an economic slowdown soon. Back in May, surveys conducted by both Pulsenomics and the Wall Street Journal found that many housing experts expect this next economics slowdown (recession), to occur in 2020.

Understandable Concerns

Because the previous recession began back when the “housing bubble” burst in 2008, some potential buyers are understandably concerned that another housing crash is imminent. They worry that now may not be the best time to buy a home.

The experts surveyed by Pulsenomics on the other hand, know that recessions and housing crises don’t always coincide. They think that monetary policy, trade policy, or a stock market correction are far more likely triggers for the next recession than a housing market correction. In fact, housing was 9th on their list.

Still a Good Investment

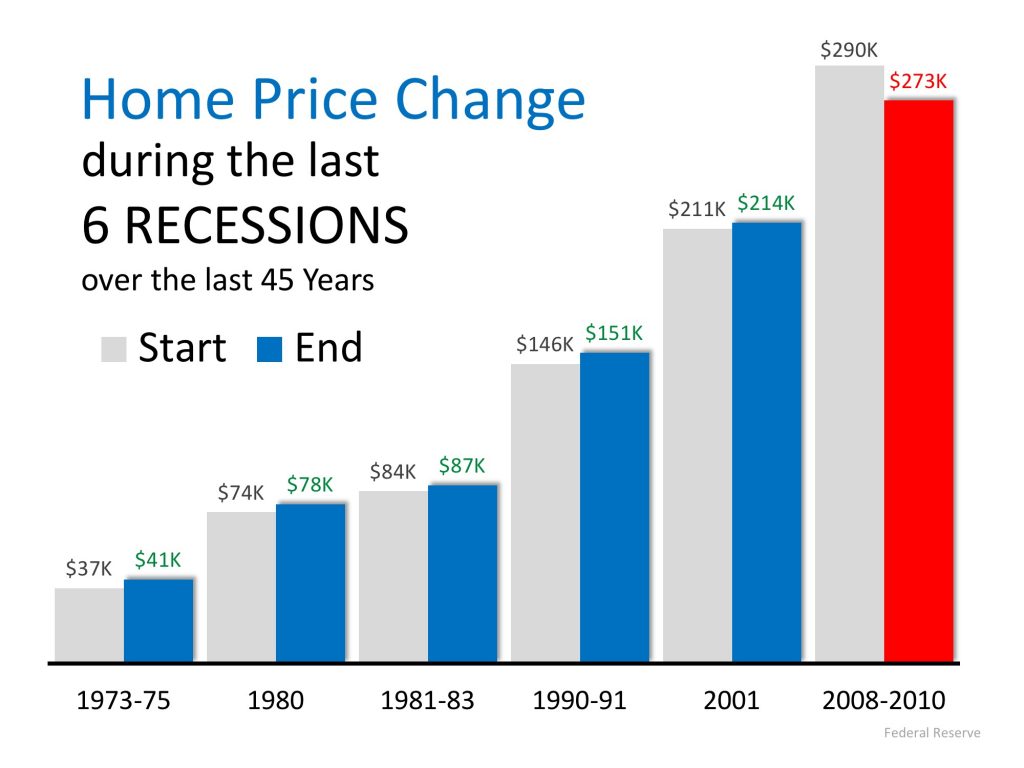

A house is the biggest investment most people make in their life. It would be horrible to spend a lot of money on a house only to have its value drop sharply a few months later. Happily, with the exception of the 2008 recession, home values have actually increased during the economic recessions of the last 45 years.

Prior to the bubble, homes appreciated at around 3.6% annually. Since the bubble, home values have increased at a higher rate, around 6.2%. As mortgage rates rise and home inventory increases, the rate of appreciation may slow down a little and begin to return to historical rates, but houses will continue to appreciate. In other words, houses are still good investments.

Ready When You Are

When you’re ready to invest in your future by buying a new home, AZ Mortgage Brothers will be ready to help you do it. Contact us to see how we can help you get into the home of your dreams!

BACK TO LIST