What you need to know about Mortgage Insurance

04-03-2017About MortgagesEddie KnoellThere is a lot of confusion about mortgage insurance out there. Hopefully we can clarify the facts.

Did you know:

Did you know that credit scores have a HUGE impact on the mortgage insurance rate? The monthly mortgage insurance payment difference between a borrower who has a 660 credit score and a 761 is $208/month (on a $250K loan).

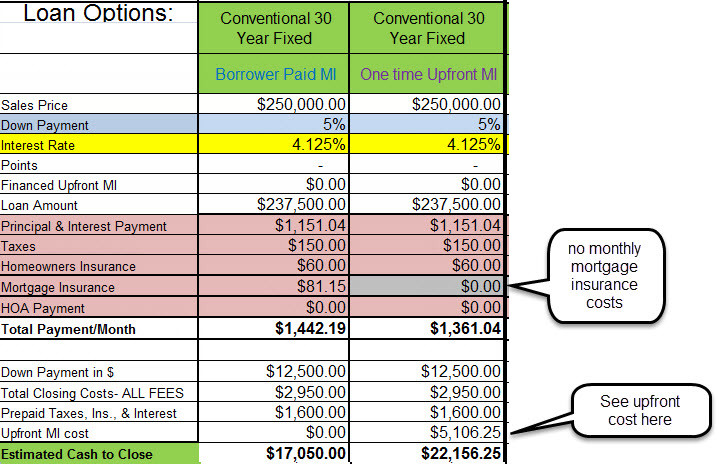

Did you know that on Conventional loans you have the option to pay mortgage insurance either monthly OR a one time upfront fee?

Did you know that FHA mortgage insurance is not PMI? PMI is ‘Private Mortgage Insurance’. It is called private because it is not government issued mortgage insurance. PMI only applies to Conventional and non government related loans.

Did you know that FHA mortgage insurance is issued by the government agency of HUD? Did you know FHA has 2 mandatory mortgage insurance payments they receive from the borrower? Borrower pays upfront mortgage insurance AND monthly mortgage insurance.

Did you know that if a borrower puts less than 10% down on a FHA loan, the mortgage insurance stays on for the life of the loan? You can read about the cancellation rules here.

See the difference between Mortgage Insurance paid monthly versus paid upfront. This assumes a credit score of 761 or greater:

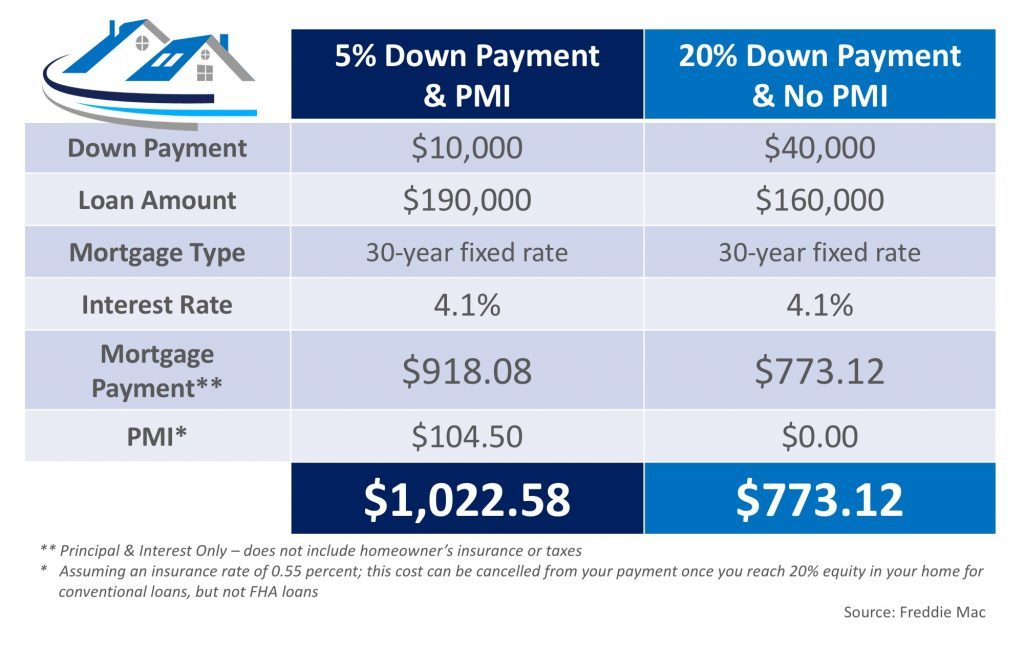

Here is a great graphic that shows you the difference between a 5% down with mortgage insurance and 20% down without mortgage insurance:

BACK TO LIST

BACK TO LIST