Sellers Gaining Control: A Phoenix Market Real Estate Update

04-26-2023About MortgagesAs of April 26, 2023 the real estate market in Phoenix, Arizona, is currently experiencing a seller's market with low inventory and high demand from buyers. This means that sellers have more bargaining power and can sell their properties for higher prices.

We have answers to your questions:

- How do the active listings for 2023 compare to the active listings for 2022 in Phoenix's housing market?

- How do the housing market trends in Phoenix impact, potential buyers and sellers?

- What are seller concessions, and are they increasing or decreasing in the Phoenix market?

- Which cities in Phoenix are currently buyer's markets, and which are seller's markets?

- What are the current mortgage rates in Phoenix's housing market?

There are still opportunities for buyers in some cities in the area. In this post, we will discuss some key trends and data points that can help you make informed decisions if you are interested in buying or selling a home in the Phoenix area.

Is Phoenix's Housing Market Changing in 2023 Compared to 2022?

According to the Cromford report, which is a trusted source of real estate information in the area, the number of active listings in 2022 was only 5,000 at the beginning of the year. As interest rates started to climb in February and March of that year, there was an increase in listings due to loosening COVID restrictions and greater mobility of buyers and sellers. This trend continued until the summer of 2022 when active listings nearly hit 20,000. However, this did not lead to a decrease in home prices as many had feared, due to the limited inventory.

How do the Housing Market Trends in Phoenix Impact Potential Buyers and Sellers?

As of April 2023, active listings are on a steady decline and are currently at 12,000, which is 50% below what the greater Phoenix area typically sees in a healthy market of 25,000 to 30,000 active listings.

This trend of decreasing active listings shows no sign of stopping in 2023, which could result in further home price increases. It's essential for home buyers and sellers to stay informed of these market trends to make informed decisions and gain an edge in the competitive Phoenix housing market.

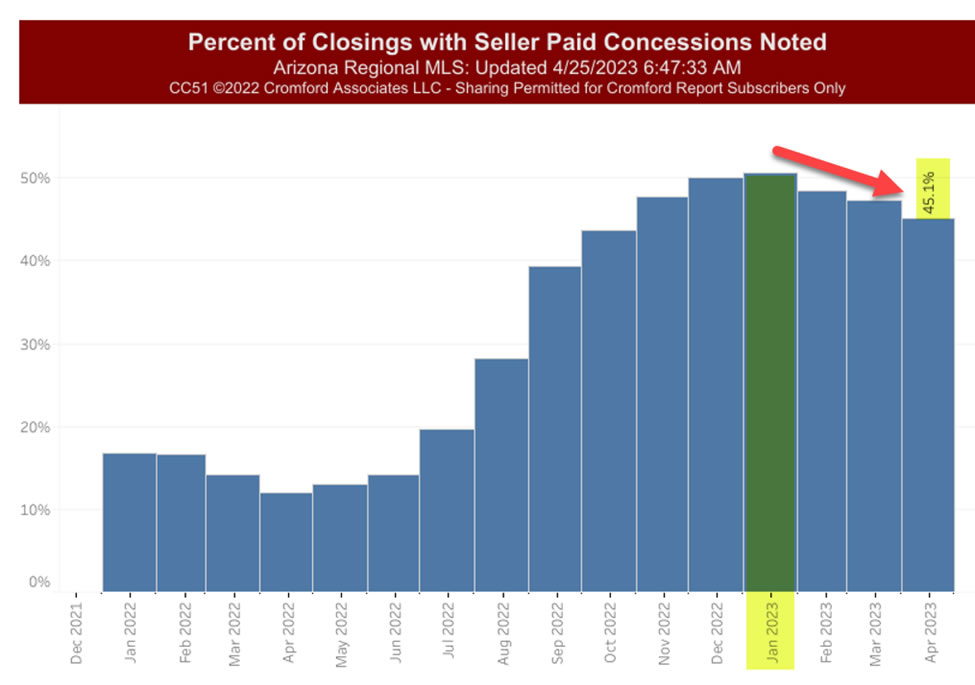

What are Seller Concessions, and Are They Increasing or Decreasing in the Phoenix Market?

One important aspect of the Phoenix housing market to track is the seller concessions that are offered. Seller concessions refer to the amount of money a seller contributes to the buyer's closing costs to help close the deal.

As mortgage brokers, we see many contracts come through and note the number of concessions given. Sellers typically offer concessions to help buyers who may not have enough funds to cover their closing costs. In May 2022, only 10% of sellers offered concessions to buyers, and buyers were paying over the list price to make the deal happen.

We began to see an increase in seller concessions from May 2022 until January 2023, with the peak being in January of that year. Since then, there has been a steady decline for three months in a row, with about half of the contracts having seller concessions.

While seller concessions are becoming more common in the current market, buyers should still expect to pay over the list price and offer other incentives to close the deal due to the highly competitive Phoenix housing market.

Buyer's vs. Seller's Markets

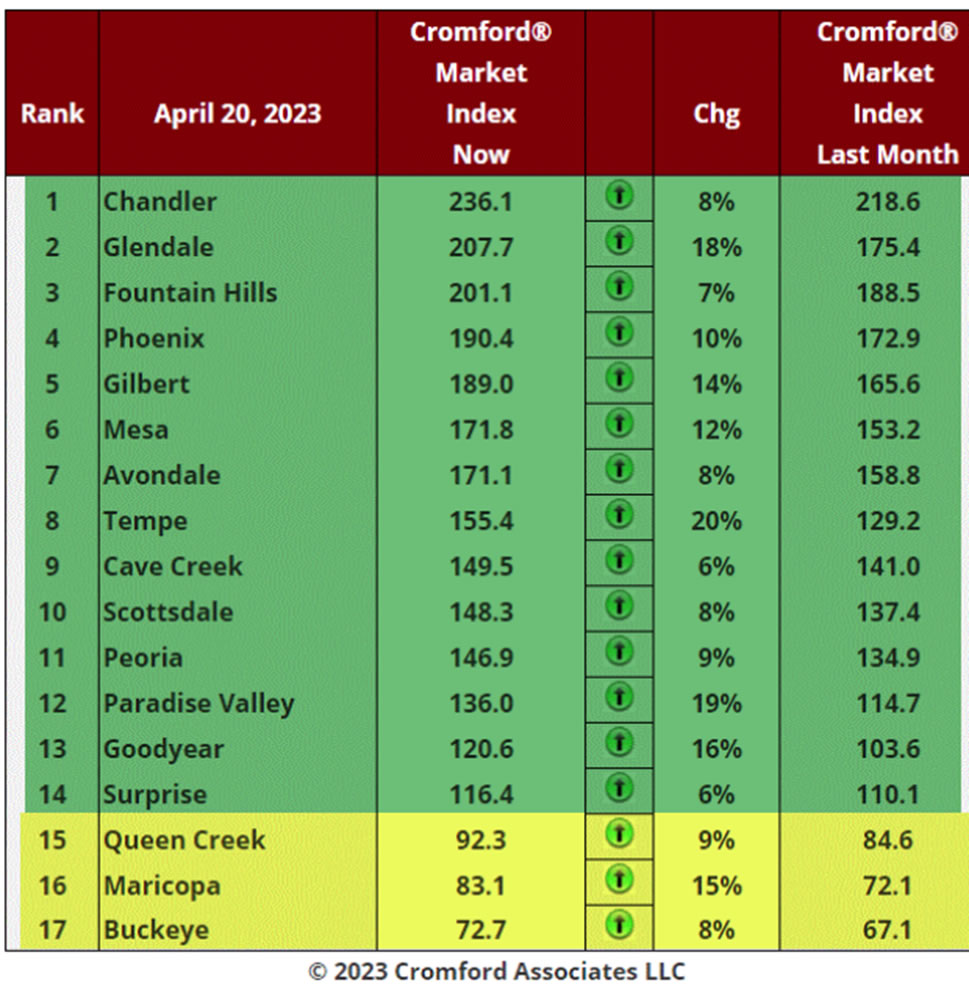

Let's take a look at the Cromford market index for the top 17 cities in the Phoenix area. This report measures the supply and demand of homes in a given market to determine whether it is a buyer's market or a seller's market.

A seller's market is defined as a market in which there are more buyers chasing fewer homes, while a buyer's market is one in which there are more homes available than there are buyers.

Which Cities in Phoenix are Currently Buyer's Markets, and Which are Seller's Markets?

The index uses a scale where anything above 100 is considered a seller's market and anything below 100 is considered a buyer's market.

In this chart, we can see all the cities in green, from Chandler to Surprise, are classified as a seller's market according to the Cromford report. This means that more buyers are chasing fewer homes, giving sellers an advantage in negotiations.

However, it's important to note that the market conditions can vary depending on the location. For example, Chandler is considered a seller's market, whereas Maricopa and Buckeye are still classified as a buyer's market. This means that there may be more homes available than there are buyers, giving buyers an advantage in negotiations.

If you're looking to buy or sell a home in the Phoenix area, it's essential to consult with a real estate agent who can provide you with up-to-date information on the market conditions in your specific location. The Cromford market index is a valuable tool that can help you understand the supply and demand dynamics in your area, but it should be used in conjunction with other data and expert advice to make informed decisions.

April 2023 Mortgage Rates

Finally, it is important to keep an eye on mortgage rates, which can significantly affect your ability to buy or sell a home. Mortgage rates are closely tied to the 10-year bond yield, which moves interest rates.

Let's discuss the 10-year fixed yield, which is an important indicator that impacts mortgage interest rates. It is widely monitored by financial experts because of its significant influence on the market. Contrary to popular belief, mortgage rates do not cause the 10-year yield to fluctuate; instead, it's the other way around. This means that the 10-year yield affects mortgage rates, but not the other way around. As mortgage brokers, we keep a close eye on the 10-year yield as it determines the interest rates that we offer to our clients.

We can observe the 10-year yield's movement through a channel, which is a graph that shows the trendlines of the bond's prices over time. This channel's long-term trend is currently trending down, but it's important to note that it can move either way in the short term. Our analysis suggests that the long-term trend will continue to decline, although this is not a prediction with absolute certainty. It's difficult to predict the interest rates with great accuracy since they can fluctuate at any time, but we hope they remain within the channel's range.

To illustrate the correlation between the 10-year yield and mortgage rates, we overlaid the 30-year fixed rate on top of the yield graph. As you can see, the two lines are closely related, with the 10-year yield having a direct impact on the 30-year fixed mortgage rates. However, it's important to note that the mortgage rates may not respond immediately to changes in the yield, taking a couple of hours or even days to catch up.

In conclusion, monitoring the 10-year fixed yield is crucial for those involved in the mortgage industry. The channel graph can provide insights into its long-term trend, although it's important to remember that it can still move in the short term. The yield has a direct impact on mortgage rates, and the correlation between the two lines can help mortgage brokers make informed decisions when advising clients.

What are the Current Mortgage Rates in Phoenix's Housing Market?

In conclusion, the Phoenix real estate market is currently experiencing a seller's market in most cities in the greater Phoenix area, with low inventory and high demand from buyers. However, some cities in the area are experiencing a more balanced market, providing opportunities for buyers to secure good deals.

Whether you are looking to buy or sell a home in the Phoenix area, it is important to work with a trusted real estate professional who can provide you with the information and guidance you need to make informed decisions.

If you would like to contact us;

Call us at 602-535-2171.

Email us at team@azmortgagebrothers.com.

Contact us today for a free quote on your next mortgage in Arizona. Our team is dedicated to providing you with personalized support throughout the entire mortgage process. Don't hesitate to reach out and see how we can help you achieve your homeownership goals.

BACK TO LIST