Air Conditioning’s Impact on Phoenix Valley Real Estate

07-24-2017About MortgagesEddie KnoellPerhaps more than any other city, Phoenix owes its existence as a modern city to air conditioning; a relatively recent invention. Although Phoenix was incorporated in 1888, it really wasn’t until the 1950s that the city began growing in earnest. That is when air conditioning became available for residential use.

READ MORE

Saving For a Down Payment After Graduation

05-23-2017About MortgagesEddie KnoellGrad Season in Arizona – Time to Talk About Planning for Homeownership

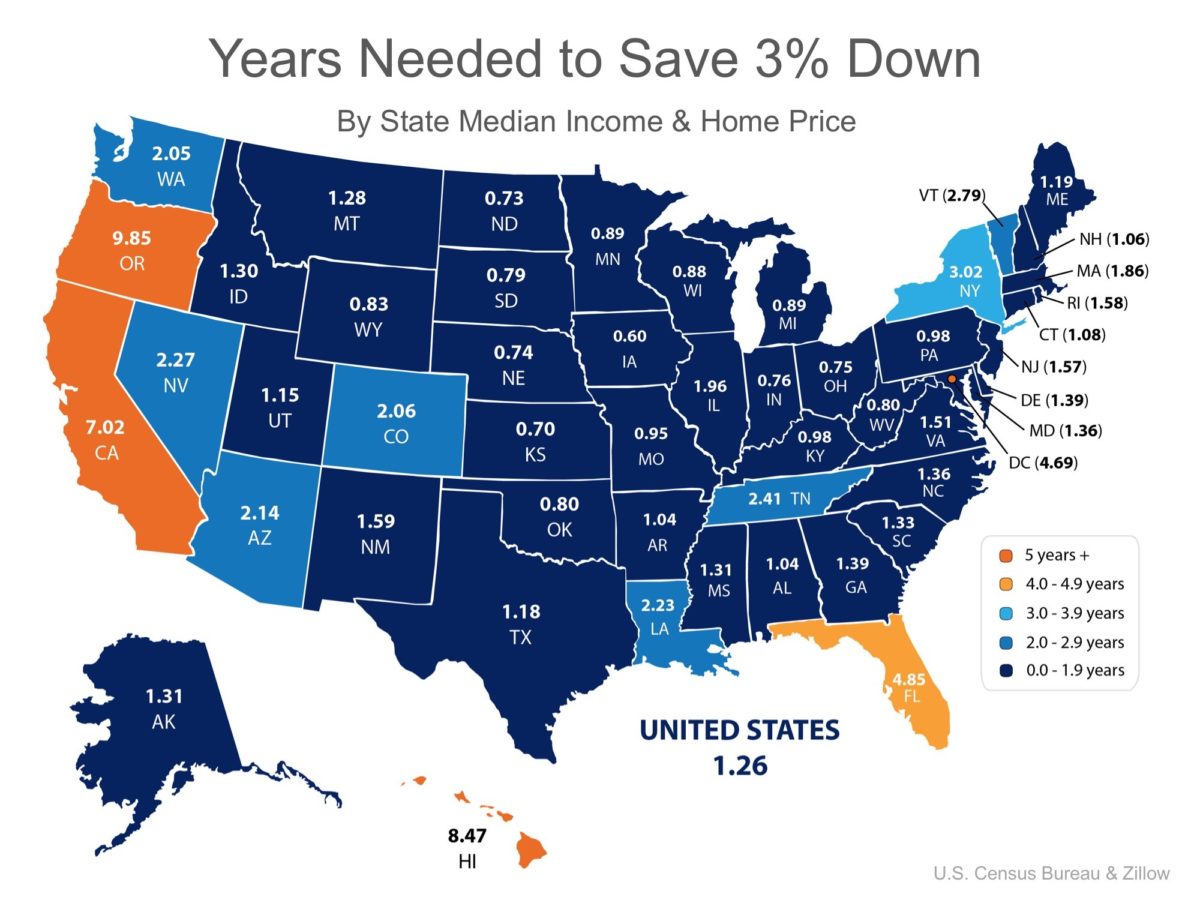

Rising prices are pushing down payments higher, while debt loads are a concern for many graduates. Today’s grads and would be buyers must develop positive money habits as early as possible to put homeownership in reach when they are ready to buy.

READ MORE

Broken ARMs – Are They Worth It To Lower Payments?

04-25-2017About MortgagesEddie KnoellRates have been lower over the last few weeks, and here in the Phoenix Valley we’ve seen the spring real estate market building on last year’s gains.

But as real estate prices rise, some buyer clients – especially those first timers – inevitably start looking for ways to get a lower rate so they can reduce their payments. In the past, one of the ways they might have considered doing this was the ARM or adjustable rate mortgage.

READ MORE

What you need to know about Mortgage Insurance

04-03-2017About MortgagesEddie KnoellThere is a lot of confusion about mortgage insurance out there. Hopefully we can clarify the facts.

READ MORE

"Final Four" Reasons Going FSBO Is A Costly Mistake

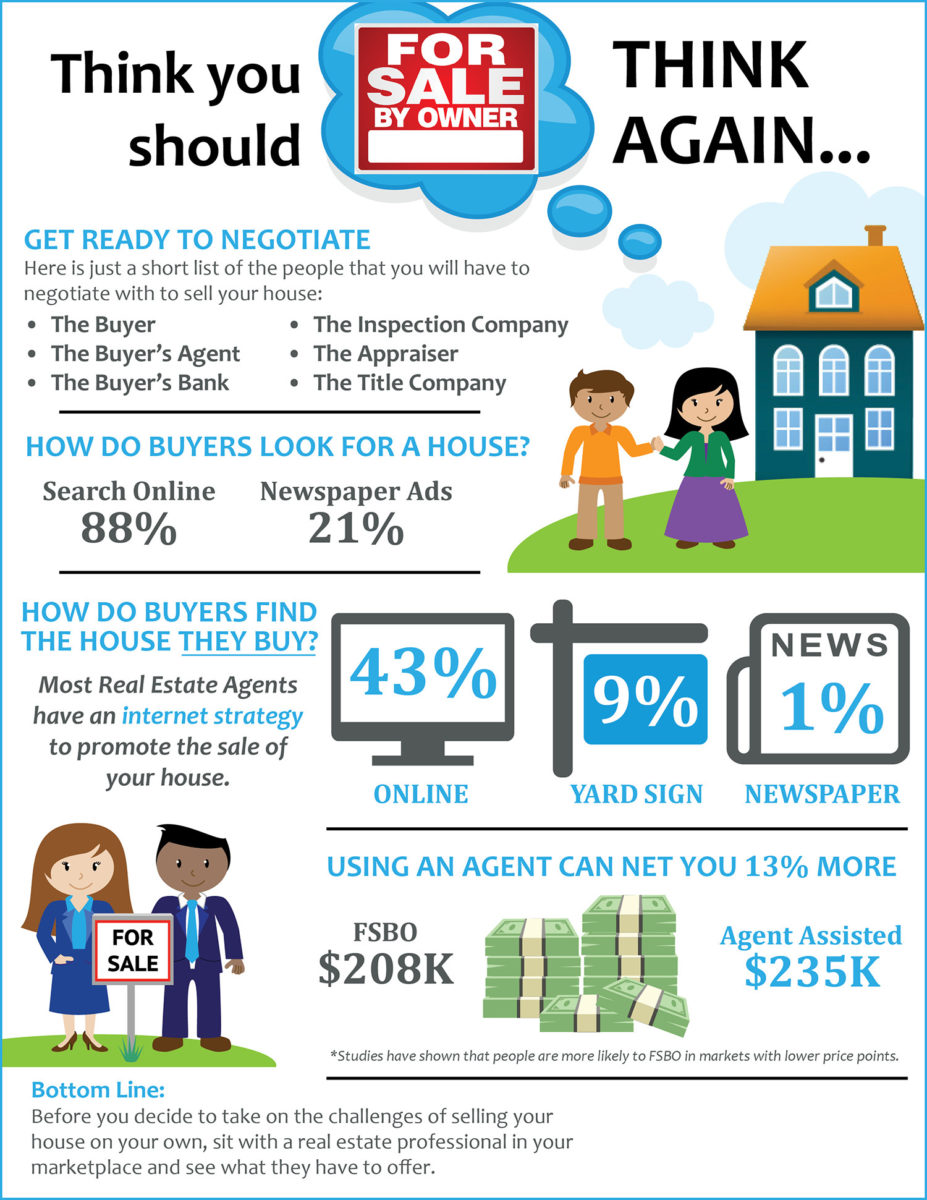

03-28-2017About MortgagesEddie KnoellIt’s interesting to point out that usually when the market gets hot, more sellers try to sell For Sale by Owner. So you’d think FSBO rates would be climbing. In fact, the opposite is true. NAR reports that FSBO sales in 2015 were at the lowest rates since data collection started in 1981, while rates of working with an agent were climbing.

It’s clear the vast majority of home sellers realize that selling FSBO is a bad idea. Here are four reasons why it isn’t the best choice for most sellers.

READ MORE

Top 3 Reasons Phoenix is America’s Hottest Housing Market

03-13-2017About MortgagesEddie KnoellNAR recently predicted that Phoenix would be the hottest housing market in the US in 2017. We could chalk it up to our awesome springtime weather, or we could talk about a few of the more compelling reasons why the Phoenix Valley real estate market is expected to do so well in 2017.

READ MORE

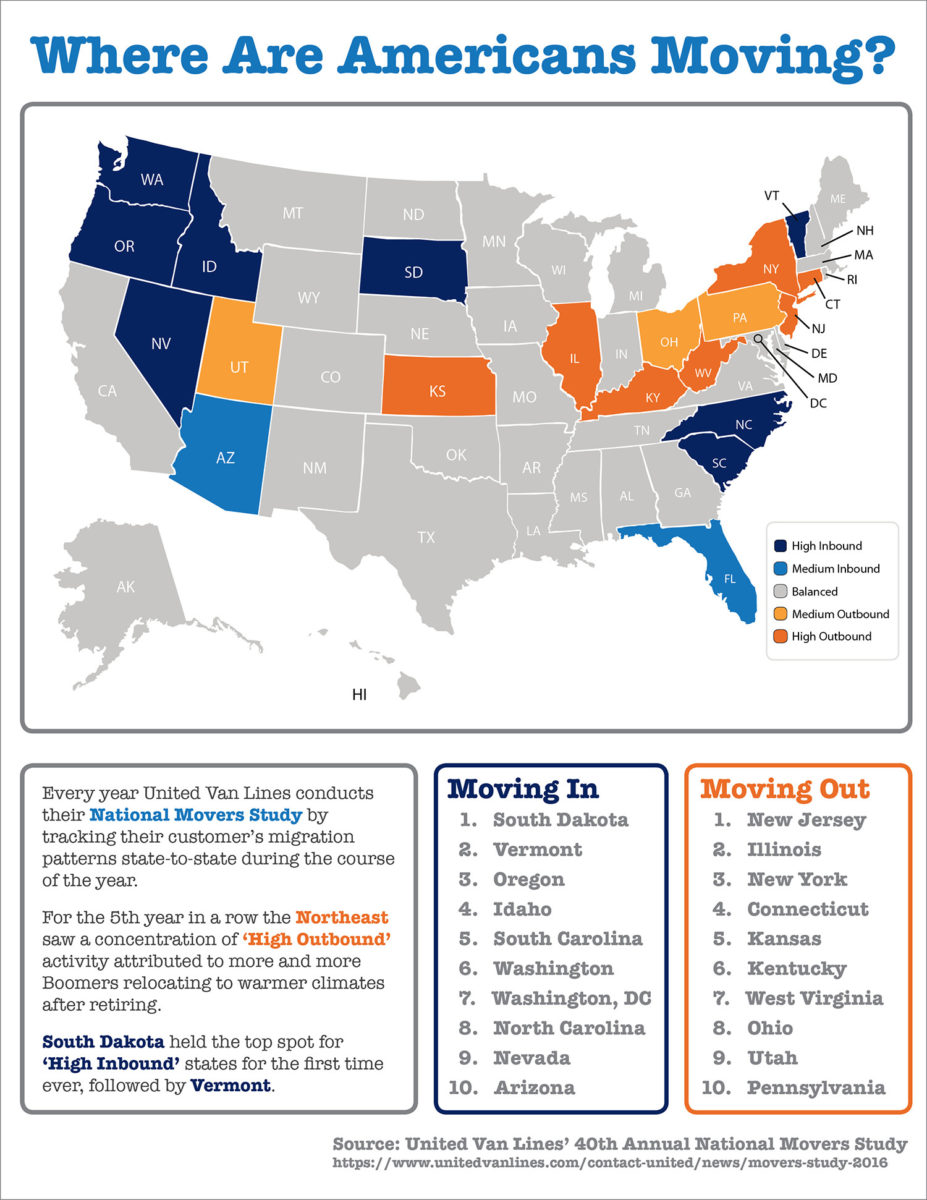

Arizona Ranks 10th in National Survey

03-13-2017About MortgagesEddie KnoellSpring is springing and as we exit recession, America’s population is on the move. But where is everyone going?

READ MORE

January 1st 2017 FHA Loan Limits are increasing

12-11-2016About MortgagesEddie KnoellThe FHA loan limit in Maricopa county for a SFR are going from $271,050 to $279,450. Did you know that FHA limits are different (higher) if the property is a ‘2 unit’, ‘3 unit’, or ‘4 unit’?

READ MORE

What’s happening with Baby Boomers and 55+ Communities?

10-21-2016About MortgagesEddie KnoellIn its recent September 29 daily observations, Cromford Reports mentioned that the 55+ communities market had seen a substantial increase in inventory, due primarily to seasonal effects. That got me thinking about some of the changes we are seeing in the 55+ market, which continues to be an important one here in the Phoenix Valley.

READ MORE

Up and Coming Neighborhoods in Phoenix Valley

09-30-2016About MortgagesEddie KnoellSomeone recently asked me, “What’s the next up-and-coming neighborhood in the Phoenix Valley?” The answer probably depends on who’s asking, but the general market of buyers are showing a preference for walkable neighborhoods near jobs and amenities, here are a few I’m watching.

READ MORE

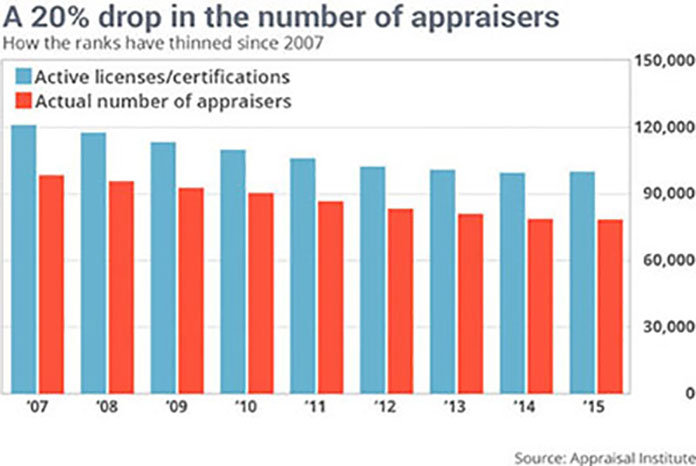

Shortage of appraisers and Increased Mortgage volume impacting real estate market

08-31-2016About MortgagesEddie KnoellAppraisals typically have a turn time of 7 calendar days after we order them. In the last 6 weeks, the increased volume in refinances and the uptick in purchases is dragging appraisal turn times out to 2 weeks or so in the Valley.

With turn times like that, we simply cannot wait until the buyer inspection period is complete to get the appraisal ordered. It is very important for Realtors to educate their buyer and sellers on these turnaround times so they are prepared.

READ MORE